I don’t know whether I’m a millionaire. It’s a disgraceful state of affairs.

This might take some going back through time. 18-21 were rough years for me. I was a bogan nerd, newly moved to Wellington, who wanted to be a writer and was struggling to admit to himself that he also liked boys. I drank. I initially drank rum because I thought it made me seem like a cool pirate, then I moved onto $10 red wine when I realised that I couldn’t keep up a respectable sustained BAC on anything that cost $40 a bottle. I was a Kiwi at uni, which meant I could lie to myself that my drinking was a personality and not a disease. I don’t know whether it’s the booze or the depressed brainfog but parts of those years just aren’t there. Somewhere in those three years, I fell into 100 bitcoin. Maybe.

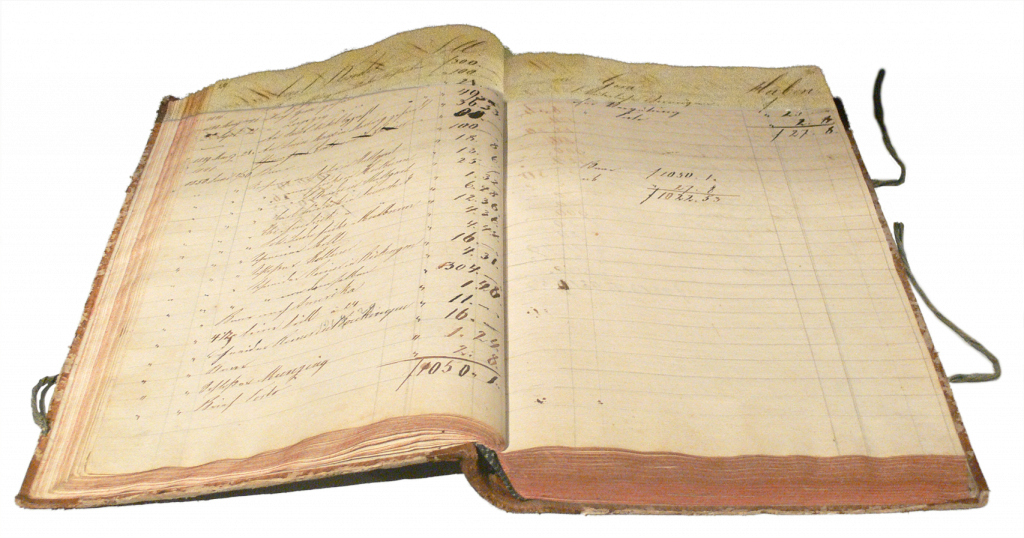

To understand Bitcoin, you first need to understand blockchain. Bitcoin is a currency that is built on a blockchain. They’re often used interchangeably but they’re not the same thing, any more than a ‘98 Toyota Corolla is an engine. The Bitcoin Blockchain is the largest and best-known, so it’s often referred to just as “The Blockchain”, which is where a lot of the confusion comes from. A blockchain is a distributed ledger. Which is exactly what it sounds like. You’ve seen a ledger before:

Or not—I don’t think I’ve ever seen a physical ledger for years, but you get the idea. Whenever a transaction happens, it gets written down. Because it’s written down, you can refer back to it whenever there’s a dispute about who did what and who owns what. This is critical because—if there was no ledger—you could get one bitcoin, copy it 100 times, and become a millionaire. The bitcoin ledger records a unique code for your transaction, as well as the specific amount of money that changed hands. Each time a new user is involved in a transaction, the chain gets one block longer.

The ledger is distributed in that it’s available to anybody who wants to access it. You can see a copy of the Bitcoin Blockchain in action right now, if you want. Each block in the blockchain must match every other block: if the transaction data in a particular block is different from the other thousands and thousands of blocks, then it’s immediately obvious that it’s fraudulent.

The actual details of the transaction (such as details that would let somebody try to clone or steal the bitcoin) are hidden, but that it took place is available to anybody with access. This is why—according to a persistent rumour—MI5 were talking about having spies communicate on an internal blockchain: you’d have a record that two parties met without having to compromise the details of their meeting. Don’t get me wrong, it’s an awful idea, an aggressively unwise idea, it’s just not quite as bad as it looks from the outset. You have a record of a meeting, but no names, no details. It would make it much more difficult for counterintelligence to interfere. It would also produce a massive amount of metadata all in one centralised place that becomes a huge target for anybody looking to compromise your operation. A single exploit, and you’re screwed. Which, being fair, is the case for a lot of encryption.

In 2010, I took a writing gig on a bbcode geek forum. Somebody wanted me to write a poem for his girlfriend. It was their anniversary. At the end of it, he told me he didn’t have any cash, but he had bitcoin. I was furious. I sucked it down. He told me they’d be worth more in a year. I didn’t have the storage space for them, so I went out and bought a drive. It was the cheapest one I could find and it cost me $200, because external storage costs in 2010 were a motherfucker. I was even more furious. I was $200 in the hole because this asshole was paying me with monopoly money, on the promise it would turn to gold. I put the bitcoin (and, critically, the private key) on the drive, stowed it quietly away somewhere, and lost it.

That drive, if the heat and damp or the elements haven’t got to it, is currently worth $1,764,885 NZD, less $200 for the cost of the drive. I have searched everywhere for it. I’ve probably spent a solid two months in lost weekends trying to follow my own dead, erratic trail. Maybe I sold the bitcoin in a blackout, or maybe the drive got eaten by the couch cushions, shuffled away into the realm of lost socks. From the bottom of my heart, I hope that dude had a great anniversary, because he paid a million bucks for it.

Maybe.

Like I said, I was drinking a lot. I’m not willing to confirm anything that happened between 2008 and 2011 with any degree of certainty. But I remember the colour of the drive (red, a sort of deep plum-red, like old blood or bad wine), the place I got it (the Dick Smith off Lambton Quay, the one I had a fight with my girlfriend in), and the motherfucking weird flat two-pronged proprietary input that kept coming out for no reason and wasn’t compatible with any other device known to god or man.

Who regulates bitcoin? Well, nobody. That’s sort of the point, and that’s why your libertarian friend will never shut up about it. No bank nor government controls bitcoin. The Blockchain does, in that transparency regulates it. You can’t cheat the blockchain; if you got money, it’s because somebody agreed to give it to you. It is pure capitalism: capitalism totally without restriction or outside influence. That’s also why it has constant massive peaks and troughs of value—the only people regulating it are the people buying it. It’s the sort of thing that would’ve made Rothbard wake up at 3am with damp sheets. That’s why people are getting rich, and that’s why people are losing everything. It seems like chaos from the outside, but to those riding the lightning, that’s just how it goes. That’s part of the reason the price is so elevated: what’s called noise trader risk.

Noise traders are people buying stocks not based on their actual value (the signal) but all the random bullshit around it (the noise). Usually, if something is overvalued and a bubble is about to burst, stock traders go crazy shorting it—they’re betting that it’s going to fail, so they make money when it goes down. Shorting is seen by a lot of economists as a critical process for finding the ‘real price’ of something, that is to say, the price that lines up with its actual value. Noise traders complicate that, because bubbles that should burst often don’t, or at least don’t when you’re expecting them to. If you short too early you can lose a lot of money, and if the community around a particular stock or item aren’t acting on the same assumptions you are then, well … it becomes scary to short. If your only contact with this idea is The Big Short, then it might’ve suddenly clicked why Christian Bale’s character freaked the fuck out when the housing market didn’t crash as predicted: because the ratings agencies were lying about its actual value, it didn’t go down when it should’ve, and the real trader (Michael Burry) lost his company billions. Bitcoin has some of the noisiest traders in the world, and that meant that nobody was willing to try and bring the price down. The absence of that, it ballooned wildly.

I think the most likely case is that I sold the bitcoin to buy more wine. I don’t remember doing that, but memory is a rickety machine at the best of times. There’s no transaction code anywhere I can find but that’s no surprise—I probably deleted it like the first one. The whole wallet was worth less than $20, and who keeps a receipt for $20? It was a decent year, the one where things finally started to look up. I was living in tumbledown borer-infested flat which was $200 a week and falling to pieces, but close to work, so it was a gem.

Taika Waititi would be out and about sometimes. I was 20 and wanted to be a writer. He was famous; he’d just come back from the US after filming a TV show. Brett and Jermaine were cool and all, but Taika was a writer. I never spoke to him, but I’d pass him in the street and act like a total starstruck weirdo. He had nice eyes. I remember very little from 2010 but I remember that Taika had nice eyes and they made me ask questions, and the questions made me drink. I would’ve paid 100 bitcoins for a coffee with Taika in a heartbeat. Even today, it’s a coin flip.

Why would you want a blockchain? Well, because you want a simple, deep ledger that records whenever a transaction takes place. I’m sure you can think of legitimate uses for that. Hell, I’m sure the accountants among you are crossing your legs under the desk, trying to pretend you’re not seeing a whole universe of possibilities unfold like a blossom in spring. Undeniably, blockchain can be a force for good.

It’s also, unfortunately, a buzzword beloved of cranks and grifters, and every slick second son who dreams in dollar signs. It’s a fiscal wild west: the folks back east hear about gold and adventure, and all the detail gets flattened out. I’m not going to lie and tell you I’m a devoted capitalist—once you’ve read The Conquest of Bread, there’s no going back. I do however understand why there’s so many Bitcoin devotees out there: it is pure, chaotic, joyful freedom. It’s freedom that could take you to the stars or put you face-first in a ditch and you only get to find out which after you get there.

What’s really bizarre about my story is how common it is. While researching it, it took less than an hour to find a friend who said “oh yeah, me too. Huh. Wild.” Not the drinking or the sadness or Taika’s wonderful eyes, but the fortune in bitcoin that they shrugged their shoulders at, and lost. Sold for beer money because they didn’t know what to do with it. 2010 was like that: the world wasn’t on fire yet; Nazis only existed in video games; we were kids playing with grenades. That drive would pay my student loan 30 times over. It’s almost Auckland house money. I went back to the tumbledown flat a few years ago, and the place was gone. It got demolished at some point, and it was a vacant lot. I spent an afternoon looking for red, and found nothing. They’ve built a new house there now. Maybe one day the drive will come back to me, red like old wine and bad blood. Until then, I get to wonder about what could’ve been.

In another life, I’m a millionaire. In the next life down, I’m friends with Taika.

It’s a coin flip.

Some locations and details in this article, as well as some part of the timeline, have been fudged to prevent identification; I don’t want to be the guy who gets a treasure hunter killed rooting around a construction site.

Be First to Comment